Market Update Miami

Lateral Movement Overview

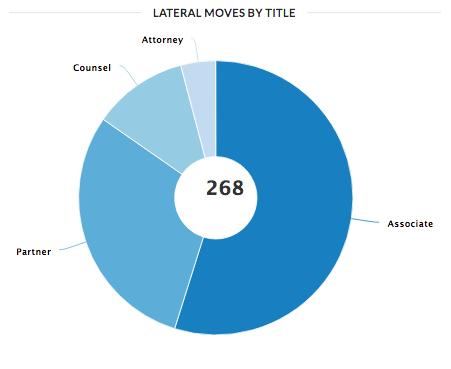

Over the last 12 months, there were a total of 268 lateral attorney moves in Miami. 147 with Associate, 80 with Partner, 30 with Counsel and with 11 Attorney titles. The top five practices with the most movement are as follows:

Litigation- 41% of Lateral Moves

Insurance- 13% of Lateral Moves

Corporate- 12% of Lateral Moves

Real Estate- 11% of Lateral Moves

Labor & Employment- 9% of Lateral Moves

Lateral data copyright 2018 Firm Prospects, LLC. All rights reserved. Used with permission. Not for redistribution.

Lateral data copyright 2018 Firm Prospects, LLC. All rights reserved. Used with permission. Not for redistribution.

Coming and Going

PARTNERS: The biggest splash in Miami over the last twelve months is the merger of Nelson Mullins and Broad and Cassel’s ten Florida offices. The Miami office of Nelson Mullins now has fourteen partners with a breadth of experience including corporate, tax, health care, securities litigation and government investigations. Shutts & Bowen expanded their Miami office with four including two litigators from Akerman and Shook Hardy, a labor & employment lawyer from Foley and a corporate banking partner from Holland & Knight. Buchanan Ingersoll expanded their immigration group with two partners from Weiss Alden Polo. They also added a family law partner from Buckner Shifrin. Other firms with two or more lateral gains include: Goldberg Segalla had two litigators from Sedwick join. Clyde & Co had two insurance litigators from Hinshaw join. And Wargo French had two bankruptcy partner from Tripp Scott join the office.

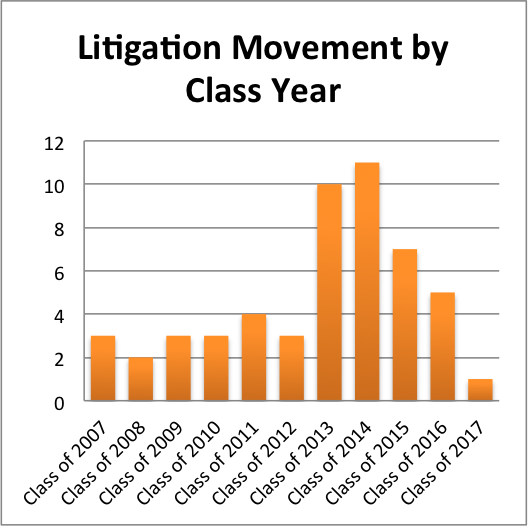

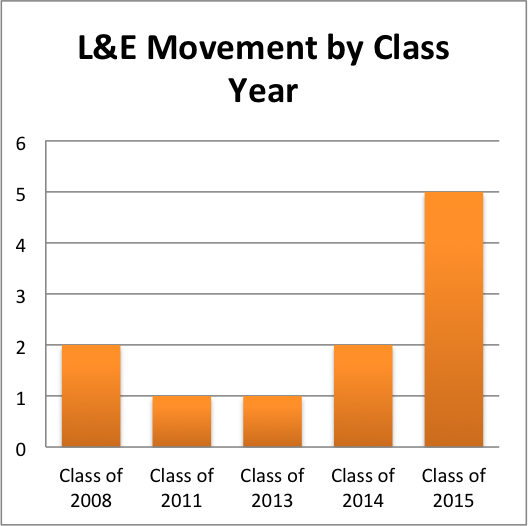

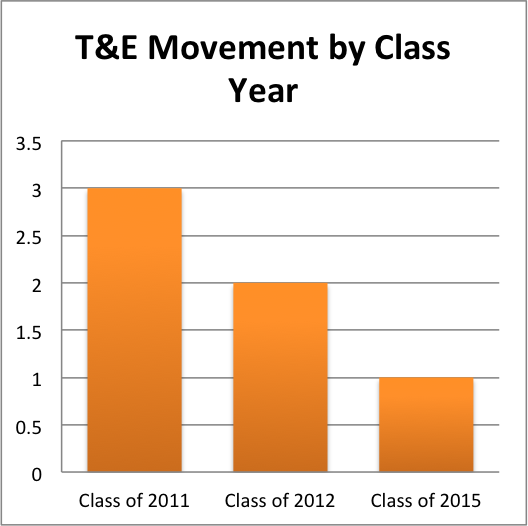

ASSOCIATES: The graphs below illustrate the movement by class year in practices with the most activity.

TOTAL EXPANSION AND CONTRACTION BY FIRM

Lateral data copyright 2018 Firm Prospects, LLC. All rights reserved. Used with permission. Not for redistribution.

Lateral data copyright 2018 Firm Prospects, LLC. All rights reserved. Used with permission. Not for redistribution.

Want to Know Who Went Where?

HERE IS THE FULL LIST OF LATERALS, INCLUDING NAMES AND PRACTICE AREA:

Current Trends

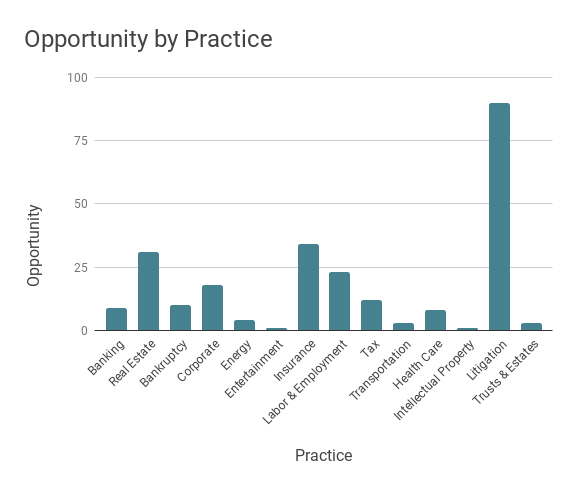

The graph below indicates the number of open positions by practice area.

The past top five practice areas continue to surge. Here is why:

Litigation - Litigation spending continues to be on the uptick after years of reduction and top CLO's expect a10% increase in Litigation matters. Complex Commercial Litigation matters are at peak levels while companies are reducing their law firm rosters by 20%. This is creating a major influx in litigation work for those firms that remain on the lists. (1)

Insurance - Litigation continues to be the avenue of choice for those involved in insurance disputes. This is due to a variety of factors including litigation funding and larger verdicts. Miami is home to several powerhouse insurance litigation firms and premier insurance litigation partners. As the pipeline continues to remain full with work, demand for associates will continue.

Real Estate - With an economy that continues to expand, commercial real estate continues to steadily grow as well. Miami’s landscape and it’s outskirts are evidence of the commercial real estate activity, with multi-family and multi-use developments at peak levels. In addition to the dirt, practices in Florida with strong lender and buyer side finance teams are experiencing more demand and looking for talent.

Labor & Employment - L&E continues to be a demanding area of expertise due to several factors including changes and/or reductions in federal employment laws but increases in state and local government actions, a resurgence in "failure to hire" litigation, sexual harassment issues and non-union NLRA issues that have increased, in part, from the rise of social media.

Corporate - An active M&A environment continues with strong deal volume in 2018 as companies continue to look for opportunities to bolster modest organic growth. Meanwhile, the regulatory and geopolitical challenges remain. For example, the U.S. Department of Justice’s appeal to block AT&T’s acquisition of Time Warner, coupled with increasing scrutiny around Chinese investments in the U.S., demonstrates that the regulatory environment may remain challenging but this will create a need for additional expertise to manage the landscape. (2) Lastly, the recent U.S. tax reform has created opportunities for U.S. companies to repatriate cash to the U.S. and corporate tax expertise will continue to be a valuable asset to any corporate group.

What does this mean for attorneys interested in exploring the market? It means opportunities are abundant. Even for attorneys with expertise outside of the top five “in demand” practice areas, firms are growing and looking for stellar talent. We have relationships with a number of firms in Houston and across the country. Our goal is to make lasting matches that lead to long term success for both the firm and the candidate. If you are an attorney that is considering your future, now is the time to assess the market and explore any opportunities that may be a better fit. If you are ready for a career consultation go HERE.

(1)BTI Consulting, Litigation Outlook 2018

(2)JP Morgan Global M&A Outlook