Market Update Atlanta

Lateral Movement Overview

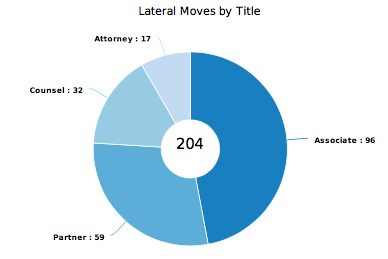

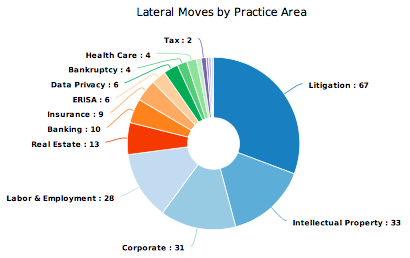

Over the last 12 months, there were a total of 204 lateral attorney moves in Atlanta. 96 with Associate, 39 with Partner, 32 with Counsel and 17 with Attorney titles. The top five practices with the most movement are as follows:

Litigation - 34% of Lateral Moves

Intellectual Property - 16% of Lateral Moves

Corporate - 16% of Lateral Moves

Labor & Employment - 14% of Lateral Moves

Real Estate - 6% of Lateral Moves

Coming and Going

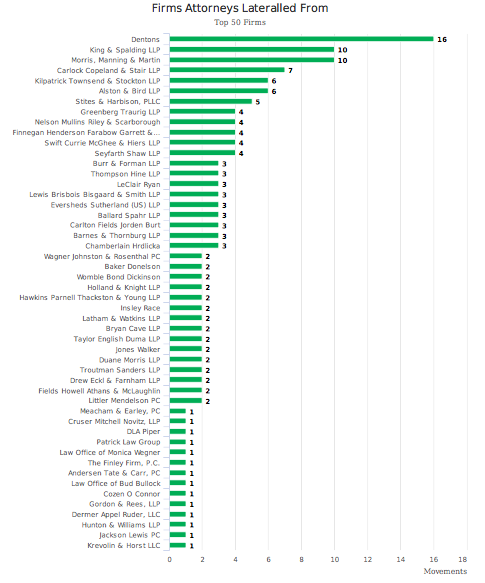

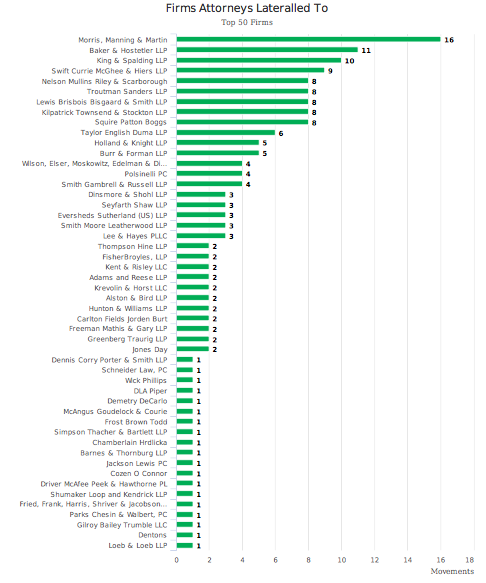

PARTNERS: Baker & Hostetler, Burr & Forman, Squire Patton Boggs, King & Spalding and Troutman Sanders took full advantage of a fluid partner market. Baker & Hostetler snagged six partners from LeClair Ryan and Morris Manning to strengthen their Labor & Employment and IP practices. Burr & Forman, an AmLaw 200 firm that rose up the ladder five slots last year, used laterals to spur growth, including a Bankruptcy and two Labor and Employment partners in Atlanta from Sites Harbison. Meanwhile, Squire Patton Boggs planted a flag in Atlanta with three partners from Dentons. The new office houses Corporate, Data Privacy and Litigation practices with an eye on expanding. King & Spalding and Troutman Sanders both lured Litigation partners to their groups with Alston litigators joining King & Spalding and King & Spalding and Dentons partners joining Troutman Sanders.

ASSOCIATES: Morris Manning, Kilpatrick, King & Spalding, Baker & Hostetler and Nelson Mullins take the top spots when it comes to attracting lateral associate talent. Morris Manning expanded their Corporate, Banking and Real Estate practices with ten laterals. Kilpatrick continues to be an IP and Litigation powerhouse with six laterals. King & Spalding added five laterals to the Corporate, Banking, Litigation and Healthcare groups. And Baker & Hostetler and Nelson Mullins each added four laterals. Baker & Hostetler continues to fortify strong Healthcare and Labor & Employment practices while Nelson Mullins added to the Corporate, Banking and Real Estate practices.

The graphs below illustrate the firms with the most lateral movement to and from. The figures are inclusive of all titles. This Detail Movement report provides the list of all laterals who moved in the last twelve months.

Current Trends

The graph below demonstrates the current demand for talent by practice. The past top five practice areas continue to surge. Here is why:

Litigation - Litigation spending continues to be on the uptick after years of reduction and top CLO's expect a10% increase in Litigation matters. Complex Commercial Litigation matters are at peak levels while companies are reducing their law firm rosters by 20%. This is creating a major influx in litigation work for those firms that remain on the lists.*

Corporate - An active M&A environment continues with strong deal volume in 2018 as companies continue to look for opportunities to bolster modest organic growth. Meanwhile, the regulatory and geopolitical challenges will remain. For example, efforts by the U.S. Department of Justice to block AT&T’s acquisition of Time Warner, coupled with increasing scrutiny around Chinese investments in the U.S., demonstrates that the regulatory environment may remain challenging but this will create a need for additional expertise to manage the landscape. Lastly, the recent U.S. tax reform has created opportunities for U.S. companies to repatriate cash to the U.S. and corporate tax expertise will continue to be a valuable asset to any corporate group.

Labor & Employment - L&E continues to be a demanding area of expertise due to several factors including a resurgence in "failure to hire" litigation, sexual harassment issues, reduction in federal employment laws but increases in state and local government actions, and non-union NLRA issues that have increased as a result of social media.

Intellectual Property - We still need to see what impact the U.S. Supreme Court’s case in Oil States Energy Services will have over PTAB cases and IP litigation in general, but there are currently no signs of a slow down. We are consistently hearing requests for IP litigators at all levels and the level of urgency indicates that there is a healthy pipeline of work. In addition to IP litigation, Atlanta has firms with premier well-rounded IP practices that assist clients with IP prosecution, trademark and licensing matters. In an age of rapid innovation the demand for transactional IP lawyers seems to never cease. This includes the rapidly growing tech transactions sub-practice that will only continue to grow as more industries see technology licensing and joint ventures as an increasingly integral component of doing business.

Banking - Finance has continued to flourish, particularly among top PE platforms with strong debt finance practices. Middle market finance practices with top lender side practices are also continuing a resurgence in Atlanta.

What does this mean for attorneys interested in exploring the market? It means we are at a moment in time where opportunities are abundant. Even for attorneys with expertise outside of the top five practice areas in demand, firms are growing and looking for stellar talent. We work with a number of firms in Atlanta and across the country to make lasting matches that lead to long term success for both the practice and the candidate. If you are an attorney that is considering your future, now is the time to assess the market and explore any opportunities that may be a better fit. If you are ready for a career consultation go HERE. Or, fill out the form below to join our newsletter.

Want to Know More? Join Our Newsletter

We respect your privacy.

Lateral data copyright 2018 Firm Prospects, LLC. All rights reserved. Used with permission. Not for redistribution.

*BTI Consulting, Litigation Outlook 2018

**JP Morgan Global M&A Outlook