Market Update: Charlotte

Lateral Movement Overview

Over the last 12 months, there were a total of 138 lateral attorney moves in Charlotte. 79 with Associate, 25 with Partner, 17 with Counsel, and 17 with Attorney titles. The top five practices with the most movement are as follows:

Litigation- 20% of Lateral Moves

Banking- 17% of Lateral Moves

Real Estate- 14% of Lateral Moves

Intellectual Property- 7% of Lateral Moves

Corporate- 6% of Lateral Moves

Lateral data copyright 2018 Firm Prospects, LLC. All rights reserved. Used with permission. Not for redistribution.

Coming and Going

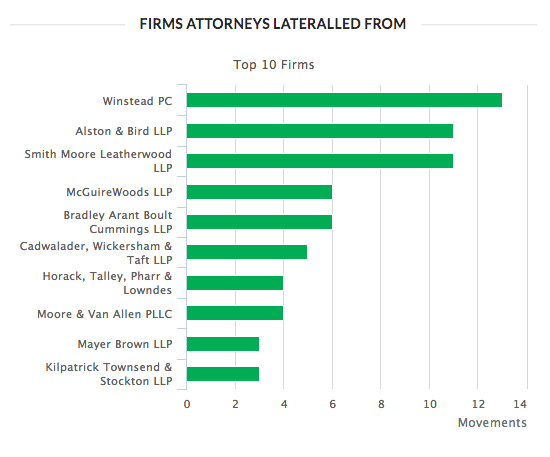

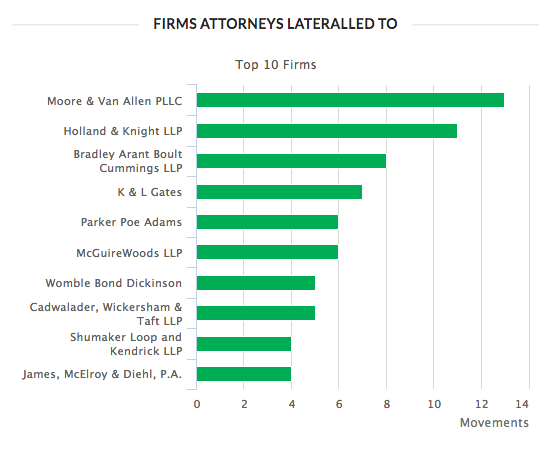

PARTNERS: A few firms have made big splashes over the past twelve months. Holland and Knight continued to get the gang back together, adding an additional five Real Estate Finance Partners from Winstead. The team moved with an additional two Counsels and three associates. With a pending merger, comes movement and a few firms became new homes to former Smith Moore Leatherwood Partners. Bradley Arant grew the senior level ranks with the addition of three Litigation Partners from Smith Moore Leatherwood and a Data Privacy Counsel from the firm. In addition, a Real Estate & Energy Partner from Steptoe added a new facet to the practice makeup of the Charlotte office. Nexsen Pruet added two IP Partners from Smith Moore Leatherwood. They specialize in prosecution, licensing and litigation. Shumaker Loop nabbed two Trusts and Estates Partners from Smith Moore Leatherwood. This is part of a larger group from Smith Moore to open an office in Charleston, SC for Shumaker Loop. Other notable mentions: Parker Poe with a Real Estate Finance lateral from Poyner Spruill and a Government lateral from McGuireWoods and Katten with the addition of an IP Litigation Partner and two Associates from Alston & Bird.

ASSOCIATES: On the Associate front, Moore & Van Allen’s Corporate and Banking groups are building formidable Associate teams adding ten in total to the groups. Alston & Bird’s Corporate group is running on all cylinders with the addition of three Associates to the team. The firm also added an IP Litigator and Government Investigations & Litigation Associate. Winston & Strawn’s Corporate, Banking and Litigation groups grew with the addition of four Associates. Parker Poe also added four Associates to their Real Estate, Corporate and Intellectual Property teams.

Lateral data copyright 2018 Firm Prospects, LLC. All rights reserved. Used with permission. Not for redistribution.

Current Trends

The graph below indicates the number of open positions by practice area.

The past top five practice areas continue to surge. Here is why:

Banking - Charlotte is finance and the work has continued to flow. Particularly among top PE platforms with strong debt finance practices. Middle market finance practices with top lender side practices are also continuing to see healthy pipelines.

Litigation - Litigation spending continues to be on the uptick after years of reduction and top CLO's expect a 10% increase in Litigation matters. Complex Commercial Litigation matters are at peak levels while companies are reducing their law firm rosters by 20%. This is creating a major influx in litigation work for those firms that remain on the lists. (1)

Real Estate - With an economy that continues to expand, commercial real estate continues to steadily grow as well. Charlotte’s Uptown landscape and it’s outskirts are evidence of the commercial real estate activity, with multi-family and multi-use developments at peak levels. In addition to the dirt, practices in Charlotte with strong lender and buyer side finance teams are experiencing more demand and looking for talent.

Corporate - An active M&A environment continues with strong deal volume in 2018 as companies continue to look for opportunities to bolster modest organic growth. Meanwhile, the regulatory and geopolitical challenges remain. For example, the U.S. Department of Justice’s appeal to block AT&T’s acquisition of Time Warner, coupled with increasing scrutiny around Chinese investments in the U.S., demonstrates that the regulatory environment may remain challenging but this will create a need for additional expertise to manage the landscape. (2) Lastly, the recent U.S. tax reform has created opportunities for U.S. companies to repatriate cash to the U.S. and corporate tax expertise will continue to be a valuable asset to any corporate group.

Intellectual Property - We still need to see what impact the U.S. Supreme Court’s case in Oil States Energy Services will have over PTAB cases and IP Litigation in general, but there based on talent demands, there are currently no signs of a slow down. We are consistently hearing requests for IP litigators at all levels from our clients with premiere IP Litigation shops. 40% of current demand can be attributed to IP Litigation. The other 60% falls in the transactional category. Firms with strong prosecution shops are looking for technical IP lawyers and other clients are looking for licensing experience for rapidly growing tech transactions practices.

What does this mean for attorneys interested in exploring the market? It means opportunities are abundant. Even for attorneys with expertise outside of the top five “in demand” practice areas, firms are growing and looking for stellar talent. We have relationships with a number of firms in Charlotte and across the country. Our goal is to make lasting matches that lead to long term success for both the practice and the candidate. If you are an attorney that is considering your future, now is the time to assess the market and explore any opportunities that may be a better fit. If you are ready for a career consultation go HERE.

(1) BTI Consulting, Litigation Outlook 2018

(2) JP Morgan Global M&A Outlook